An Overview of Personal Tax Extension Form 4868

Every individual taxpayer in the U.S. must timely file Form 1040 to the IRS to report the taxable income and expenses for the tax year to avoid penalties and interest. It helps the IRS determine whether the Individual owes the taxes or the filer will receive a tax refund.

However, if you need more time to prepare and file the tax returns to the IRS, you can apply for a tax extension using Form 4868

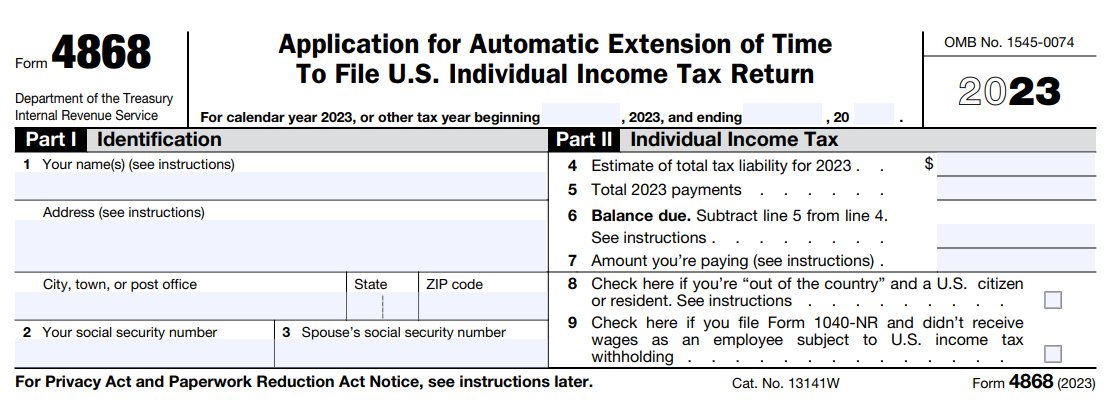

What is Form 4868?

IRS Form 4868 is a tax extension Form used for requesting an automatic extension of time up to 6 months to file your personal income tax returns.

As the Personal Tax Extension Form 4868 is entirely automatic, the IRS doesn’t require any explanation to request an extension.

Note: Filing Form 4868 will only extend the time to file your federal tax return and NOT the time to pay your federal tax due.

Who Should File Form 4868?

Tax Extension Form 4868 is for individual taxpayers, not corporations or other business entities that must file returns other than a Form 1040.

- Federal Income Tax Return Filers

- 1099 Independent Contractors

- What are the forms 4868 support?

- Sole Proprietorships (Schedule C)

- Single-Member LLCs

What tax Forms does 4868 extend?

The IRS form 4868 supports the following IRS forms:

- Form 1040

- Form 1040-SR

- Form 1040-NR

- Form 1040-NR-EZ

- Form 1040-PR

- Form 1040-SS

When is the deadline to file Personal Tax Extension Form 4868?

The Actual deadline to file form 4868 is the 15th day of the 4th month after the tax year ends.

The Deadline to file a federal 1040 income tax return is April 15, 2024. If you still need additional time up to October 15th, file Form 4868 Now.

If the form 4868 due date falls on Saturday, Sunday, or any legal holidays, the due date will be on the next business day (April 18, 2023).

How To File IRS Form 4868?

Form 4868 Extension can be filed either electronically or by paper.

However, the IRS encourages individuals to file electronically to know the status of their submitted forms instantly. Choose an electronic filing method to E-file Form 4868 for secure, quick, and more accurate filing.

If you choose a paper filing option, you need to download Form 4868 from the IRS website, fill in the required details, and then send it to the IRS using the address mentioned here.

Penalty for late filing 4868

You are required to pay the late filing penalty if you file form 4868 after the due date. The penalty is usually 5% of the amount due for each month or part of a month your return is late. The maximum penalty is 25%.

Is there any extension available for Payment?

E-File 4868 will only extend the time to file the individual income tax return and NOT the time to pay your tax dues.

You must make your payment to the IRS on the regular due date, which is April 15, 2024. Otherwise, you owe a late payment penalty between ½ of 1% of any tax (other than estimated tax). It’s charged for each month or part of a month the tax is unpaid. The maximum penalty is 25%.

The IRS will not charge a late payment penalty if you show reasonable cause for not paying on time. For this, you need to attach a statement to your return, explaining the reason. Don’t attach the statement to Form 4868.

E-filing Form 4868 with ExpressExtension

If you are looking to file form 4868 online, choose an IRS-authorized e-file provider like ExpressExtension for accurate and secure filing.

We provide a step-by-step guide to apply for an extension of time to file your Individual Income Tax Returns. Once you transmit the return to the IRS, you will get approval from the IRS instantly.

How to E-file Form 4868?

To e-file form 4868 using ExpressExtension, simply follow the below steps

- Step 1: Choose the extension type (Either individual or joint filing) you would like to file.

- Step 2: Enter your basic details such as Name, Address, SSN

- Step 3: Enter your tax payment details if you owe any taxes

- Step 4: Review your Form

- Step 5: Form 1040-PR

- Step 6: E-file your Form 4868 with the IRS.