Form 1065 Extension

Form 1065 extension is generally filed by domestic partnership which would need additional time to file 1065 return and is filed by the same date the actual 1065 return is due. Form 1065 is due by the 15th day of the third month following the date its tax year ends. For Calendar year the partnerships have to file the return by March 15.

When you request an extension for your partnership using Form 7004, you will get an automatic six-month extension to file Form 1065 with the IRS.

Please note, filing the 1065 extension does NOT extend the time to pay any tax due, it only extends the time to file the partnership return.

How do I E-file an extension for a Partnership Income Tax Return?

If you need more time to prepare and electronically file your partnership return, you can e-file an extension form 7004 through the IRS approved e-File provider.

To e-file partnership tax Extension, you need the following information:

- Your legal name, which should match with the IRS records.

- Your Employee Identification Number (EIN)

- The address of your business. If you receive mail at a P.O. Box, you need to include this address instead.

Once you have the information that matches with the IRS records, here are the steps you need to follow to complete and file an extension form 7004 for your partnership return.

Form 7004 has two parts, here we go:

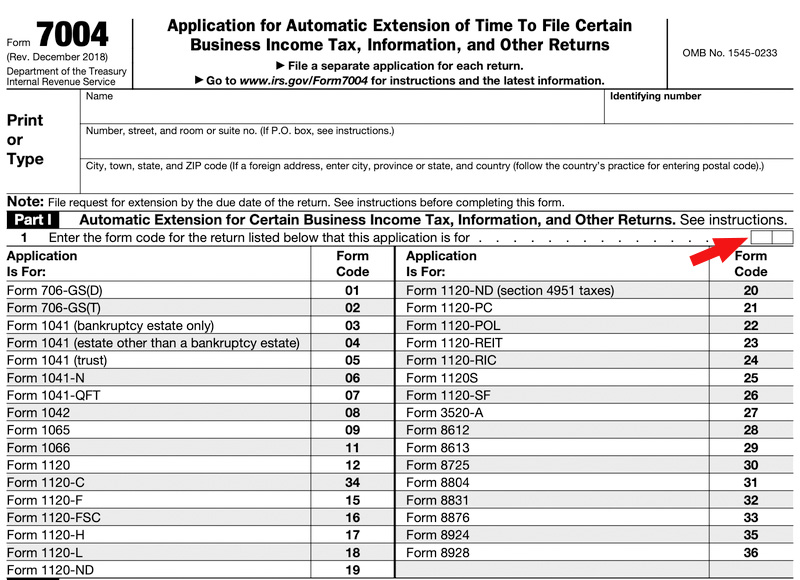

Part-I: Automatic Extension for Certain Business Income Tax, Information, and Other Returns.

Line 1:Enter your applicable form code in the boxes shown on line 1 to indicate the IRS the type of business tax return for which you are requesting an extension of time to file. For partnership return 1065, enter form code 09.

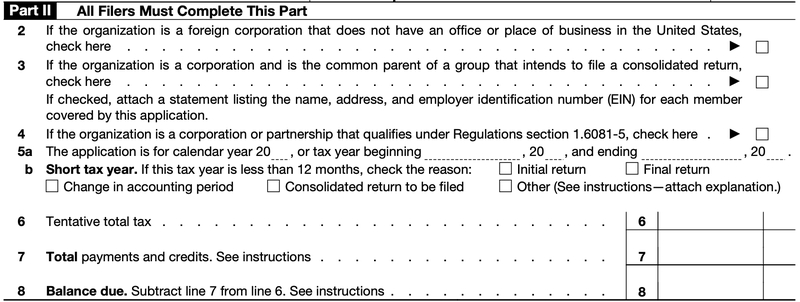

Part-II: All Filers Must Complete This Part

Line 2: In case, if you are out of the country (if your business is out of the U.S or any other foreign country) , you no need to file extension Form 7004, to extend your due date. As you can file and pay the tax due by the 15th day of the 6th month following the close of the tax year.

In case you need an extension of 3 months after the 15th day of the 6th month following the close of the tax year, you must check the box on line 2 of Form 7004 to request an extension of time to file the income tax return.

Line 3: Check the box on line 3, if you are the common parent or agent of a consolidated group requesting an extension of time to file the group's consolidated return.

Line 4: Check the box on line 4, if you are certain foreign and domestic corporations and certain partnerships whose due date by the 15th day of the 6th month following the close of the tax year.

Line 5a: If you do not use a calendar tax year (starts on January 1 and ends on December 31st), then complete the lines showing the beginning and end dates for the tax year.

Line 5b. If your business has a short tax period, Check any one of the applicable boxes on line 5b for the reason for the short tax year.

Line 6: Enter the total tax, including any nonrefundable credits, you expect to pay for the tax year.

Line 7: Enter the total payments and refundable credits.

Line 8: Enter the balance due amount, you need to pay for the tax year. Form 7004 does not extend the time to pay tax.

How long is the 1065 extension?

Properly filing 1065 Extension to the IRS will give taxpayers an automatic 6-month extension of time to file the return.

Where to file Form 1065 Extension?

Once you complete filling your 1065 Extension, you can file form 1065 Extension to the IRS using any one of the following methods:

- Electronic Filing

- Paper filing

When you choose an electronic filing option, you can e-file partnership tax Extension in minutes and get instant approval from the IRS. In case of any errors, you may also be able to make corrections without any difficulty.

If you choose to paper file it takes longer Processing time, and you will receive the IRS acknowledgment in delay. Below is the mailing addresses to mail your Form 1065 Extension

| If the partnership’s principal business, office, or agency is located in: | And the total assets at the end of the tax year (Form 1065, page 1, item F) are: | Use the following address: |

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Less than $10 million and Schedule M-3 isn't filed | Department of the Treasury Internal Revenue Service Center Kansas City, MO 64999-0011 |

| $10 million or more -or- less than $10 million and Schedule M-3 is filed | Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-0011 | |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Any amount | Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-0011 |

| A foreign country or U.S. possession | Any amount | Internal Revenue Service Center PO Box 409101 Ogden, UT 84409 |

E-File Form 1065 Extension Through ExpressExtension

ExpressExtension is a #1 IRS Authorized e-file service provider for tax extension forms. With over 10+ years of experience in the tax filing process, we provide a user-friendly filing process that helped thousands of happy customers!

When filing form 1065 extension with ExpressExtension, you can expect an easy-to-follow, interview-style format that helps you complete your extension form in minutes and receive instant IRS approval for an automatic tax extension.

Here are the simple steps you need to follow in ExpressExtension to complete and Transmit your partnership tax extension:

- Step 1: Enter your business details.

- Step 2: Choose the Form and your business entity type.

- Step 3: Enter your tax payment details

- Step 4: Review and Transmit your Form 7004 to the IRS.

In case your transmitted extension is rejected by the IRS, we help you to resolve the errors and retransmit it for free of cost.

If your extension is still not accepted by the IRS after several attempts of retransmission, we will refund your service fee- no question asked!

It is great right! So, choose ExpressExtension Today to file your Form 1065 Extension.